Executive Summary

Ondo Finance is a revolutionary platform that constructs a bridge between the decentralized finance (DeFi) and traditional finance (TradFi) landscapes. Established in 2021, Ondo facilitates the tokenization of real-world assets (RWAs) – essentially creating digital representations of traditional financial instruments like stocks and bonds – allowing them to be traded within the DeFi ecosystem. This article delves into the intricate workings of Ondo Finance, exploring its core functionalities, the benefits it offers, the technological underpinnings that power the platform, and its potential impact on the future of finance.

Unveiling Ondo Finance: A Gateway to Tokenized Real-World Assets

The financial world is on the cusp of a paradigm shift. Decentralized finance (DeFi) has emerged as a powerful force, offering innovative financial instruments and fostering a more inclusive financial system. However, a significant barrier persists – the disconnect between DeFi and traditional finance (TradFi). Ondo Finance stands as a pioneering platform aiming to dismantle this barrier by introducing real-world assets (RWAs) onto the blockchain.

RWAs on the Blockchain: A New Frontier in DeFi

Real-world assets encompass a broad spectrum of traditional financial instruments – stocks, bonds, commodities, real estate, and more. Ondo Finance bridges the gap by creating tokenized representations of these assets. These tokens, residing on a blockchain network, function as digital substitutes for the underlying RWAs. This paves the way for a plethora of possibilities within the DeFi realm.

Benefits of Ondo’s RWA Tokenization Approach

Ondo’s approach to RWA tokenization offers a multitude of advantages for both DeFi users and traditional investors:

- Accessibility: DeFi enthusiasts gain access to familiar assets like stocks and bonds, expanding their investment horizons beyond native DeFi tokens.

- Efficiency: DeFi protocols boast faster settlement times compared to traditional markets. Additionally, potential for lower fees due to the elimination of intermediaries like clearing houses can be significant.

- Liquidity: Tokenization unlocks new avenues for liquidity for RWAs. Fragmented ownership becomes possible, facilitating easier buying and selling of traditionally illiquid assets.

- Transparency: Blockchain technology underpins immutability and transparency in transactions, fostering greater trust and auditability within the financial system.

- Fractional Ownership: Ondo allows for fractional ownership of RWAs, making them more accessible to a wider range of investors with varying capital amounts.

- Programmability: Smart contracts, the self-executing code on the blockchain, enable the creation of innovative financial products tied to RWAs. This opens doors for novel investment strategies and risk management tools.

The Technological Backbone: Powering Ondo’s RWA Tokenization

Ondo Finance leverages a robust technological infrastructure to ensure the seamless operation of its RWA tokenization platform. Here’s a breakdown of the key components:

- Blockchain Network: A secure and transparent blockchain network forms the foundation for token issuance and management. Popular choices for DeFi applications include Ethereum, Solana, and Polygon.

- Oracles: These act as bridges between the blockchain and the real world, feeding external data like asset prices and economic indicators into the DeFi ecosystem. Chainlink and Band Protocol are prominent oracle providers.

- Smart Contracts: These self-executing code snippets govern the tokenization process, defining the rules for asset issuance, redemption, and ownership transfer.

- Legal Frameworks: Ondo prioritizes a regulated environment. They collaborate with regulators and legal experts to ensure compliance with existing securities laws and establish a framework for responsible RWA tokenization.

The Future of Finance: A Glimpse Through the Ondo Lens

Ondo Finance stands at the forefront of a transformative movement in finance. The seamless integration of RWAs with DeFi holds immense potential to reshape the financial landscape. Here are some potential implications:

- Democratization of Finance: By lowering barriers to entry and offering fractional ownership, Ondo can empower a broader range of individuals to participate in the financial system.

- Increased Efficiency: Streamlined settlement processes and potentially lower fees associated with DeFi protocols can lead to a more efficient financial system.

- Innovation in Financial Products: The programmability of DeFi opens doors for the creation of novel financial instruments tied to RWAs, catering to diverse investment needs.

- Evolution of Traditional Finance: The success of RWA tokenization can prompt traditional financial institutions to adapt and embrace blockchain technology for greater efficiency and innovation.

Challenges and Considerations: Navigating the Uncharted Territory

While Ondo presents a compelling vision for the future of finance, it’s crucial to acknowledge the challenges that lie ahead:

- Regulation: The nascent nature of RWA tokenization presents regulatory uncertainties. Establishing clear and comprehensive regulations is essential for fostering trust and preventing potential misuse.

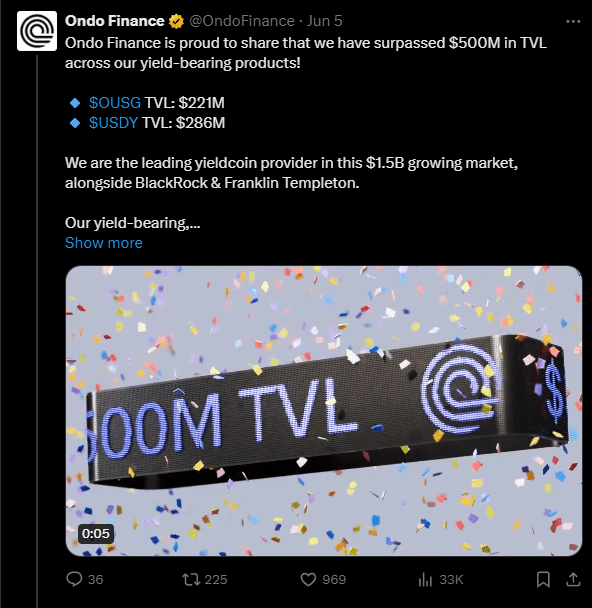

Ondo Finance Surpasses $500 Million in Total Value Locked (TVL) Milestone

Leave a Reply