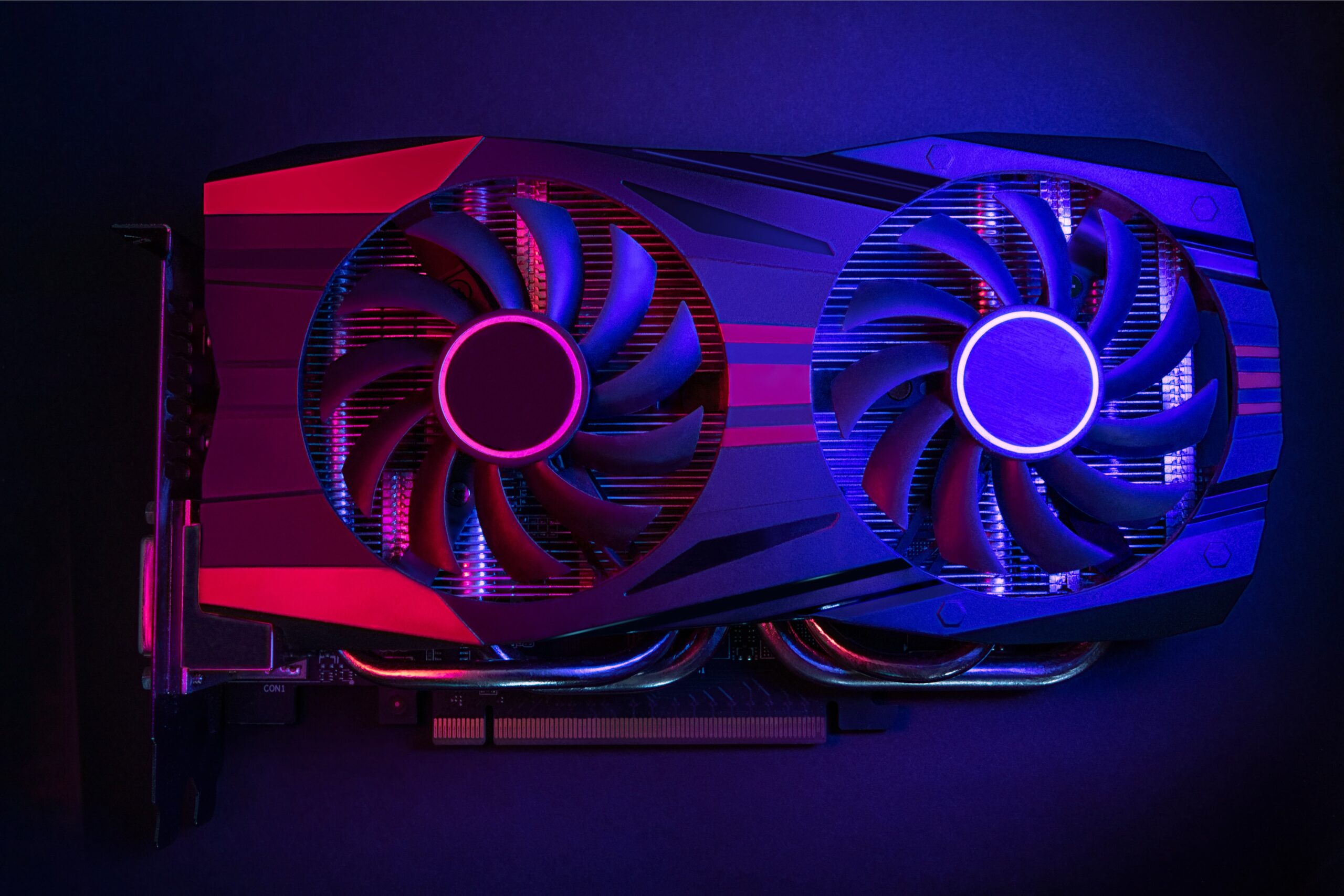

The dream of generating your own cryptocurrency through crypto mining remains a tempting proposition. But with the cryptocurrency landscape constantly evolving, is it still a strategy worth pursuing in 2024? Let’s delve into the nitty-gritty of crypto mining and explore the factors you need to consider before taking the plunge.

Profitability: A Delicate Balancing Act

The profitability of crypto mining hinges on a delicate balance between several key elements. Here’s a breakdown of the most crucial ones:

-

Electricity Costs: Crypto mining rigs are notorious for their power consumption. Before you start mining, factor in your electricity rates. Can the value of the crypto you mine outweigh the hefty energy bill you’re likely to incur?

-

Mining Difficulty: As more miners join a particular cryptocurrency’s network, the difficulty of solving the cryptographic puzzles that validate transactions (and earn you rewards) increases. This rising difficulty can significantly impact your profit margins.

-

Cryptocurrency Price: The value of the cryptocurrency you choose to mine directly affects your earnings. Cryptocurrencies are inherently volatile, so market fluctuations can significantly impact your bottom line.

Beyond Bitcoin: Exploring Alternative Avenues

Bitcoin mining, once the undisputed king of the crypto mining world, now faces stiffer competition due to its high mining difficulty. Here are some alternative approaches to consider if you’re looking to diversify:

-

ASIC-Resistant Coins: ASICs (Application-Specific Integrated Circuits) are super-powerful mining machines that dominate Bitcoin mining. Thankfully, there are cryptocurrencies designed to be resistant to ASICs. This levels the playing field for miners with less specialized hardware, potentially allowing them to compete more effectively.

-

Cloud Mining: Cloud mining offers a way to participate in crypto mining without the upfront cost and ongoing maintenance hassle of owning and operating your own mining rig. Essentially, you rent mining power from a cloud provider. However, proceed with caution – thorough research is crucial to avoid scams in this space.

Making an Informed Decision: Essential Steps Before You Mine

Before you embark on your crypto mining adventure, take some time to do your due diligence:

-

Research Profitability Calculators: Websites like WhatToMine can be valuable tools to estimate your potential earnings. These calculators take factors like your location, hardware specifications, and chosen cryptocurrency into account to provide a more realistic picture of your potential profits.

-

Factor in Hardware Costs: ASIC miners, while powerful, can be expensive. Carefully consider the upfront investment required, as well as the potential resale value of the equipment down the line.

-

Stay Updated on Market Trends: The cryptocurrency market is known for its volatility. Staying informed about mining difficulty changes, coin prices, and any relevant regulatory developments is crucial for making sound investment decisions.

Crypto Mining: Not a Guaranteed Path to Riches

While crypto mining can be a profitable endeavor, it’s important to remember that it’s not a guaranteed path to riches. Success requires careful research, ongoing monitoring of market conditions, and a dose of luck with price fluctuations. For many individuals, simply buying and holding cryptocurrency might be a less risky alternative, especially those new to the crypto space.

Bitcoin Halving

The 2024 Bitcoin halving, which cut the block reward for miners in half, is an important factor to consider when choosing an ASIC mining rig. With less Bitcoin awarded per block mined, miners need ever-more efficient machines to maintain profitability. This means a higher hash rate, a measure of mining power, becomes even more critical. Look for ASIC miners with the best hash rate to power ratio to ensure you’re maximizing your Bitcoin earnings in this new mining landscape.

Cloud Mining

Unlike traditional mining rigs that require you to purchase, set up, and maintain powerful computers yourself, cloud mining offers a more accessible entry point. Think of it like renting a plot of land and equipment for gold mining – you don’t own the physical tools, but you get a share of the potential profits. Cloud mining services provide remote access to their mining facilities, allowing you to mine cryptocurrency without the noise, heat, and high electricity bills associated with running your own rig. However, this convenience comes at a cost. Cloud mining providers typically take a cut of your earnings, and you have less control over the mining process itself compared to managing your own hardware READ MORE.

The Final Takeaway

Crypto mining offers a fascinating way to participate in the cryptocurrency ecosystem and potentially earn some rewards. However, approach it with a clear understanding of the risks and rewards involved. By carefully weighing the factors discussed and conducting thorough research, you can make an informed decision about whether crypto mining aligns with your financial goals and risk tolerance.

FAQ

What is an ASIC miner?

An ASIC (Application-Specific Integrated Circuit) miner is a highly specialized hardware device designed exclusively for cryptocurrency mining. Unlike general-purpose CPUs and GPUs, ASIC miners are optimized to perform the hashing functions necessary for mining specific cryptocurrencies, offering unparalleled efficiency and speed.

How did ASIC miners revolutionize cryptocurrency mining?

The introduction of ASIC miners transformed the cryptocurrency mining landscape by providing unparalleled mining efficiency and power. This significant technological advancement led to increased mining difficulty, the consolidation of mining activities into large-scale operations, and debates over centralization within the mining community.

What are some obstacles associated with ASIC mining?

Obstacles include the centralization of mining power, rapid obsolescence of ASIC hardware leading to increased electronic waste, and environmental concerns due to the high energy consumption associated with ASIC mining operations.

What factors should be taken into account when selecting an ASIC miner?

Key considerations include the hash rate, which indicates mining power; power efficiency, crucial for minimizing electricity costs; upfront cost and potential return on investment (ROI); and specific model specifications such as the Bitmain Antminer S19 Pro for high efficiency.

How do mining pools impact ASIC mining profitability?

Mining pools combine the hashing power of individual miners to increase the chances of earning mining rewards. Joining a mining pool can lead to more consistent earnings compared to solo mining, despite shared rewards, making it a strategic choice for enhancing profitability.

What steps are involved in setting up an ASIC mining rig?

Setting up involves unboxing and inspecting the hardware, ensuring proper location and ventilation, connecting to a power supply and the network, configuring mining pool settings, applying firmware updates if necessary, and regular maintenance to ensure optimal performance.

How can the profitability of ASIC mining be calculated?

Profitability can be determined by considering the hash rate, electricity costs, mining difficulty, and the value of the mined cryptocurrency. Subtracting daily energy costs and operational expenses from the expected daily mining rewards gives an estimate of daily profits, from which the ROI can be calculated.”

Leave a Reply